Setting up payroll for your small business is crucial to keep things running smoothly and ensure your employees are happy. But with all the steps, tax rules, and compliance requirements, it can feel overwhelming. This guide makes the payroll process easier for small businesses, covering everything from setting up payroll systems to managing taxes and year-end reporting.

Payroll for Small Businesses

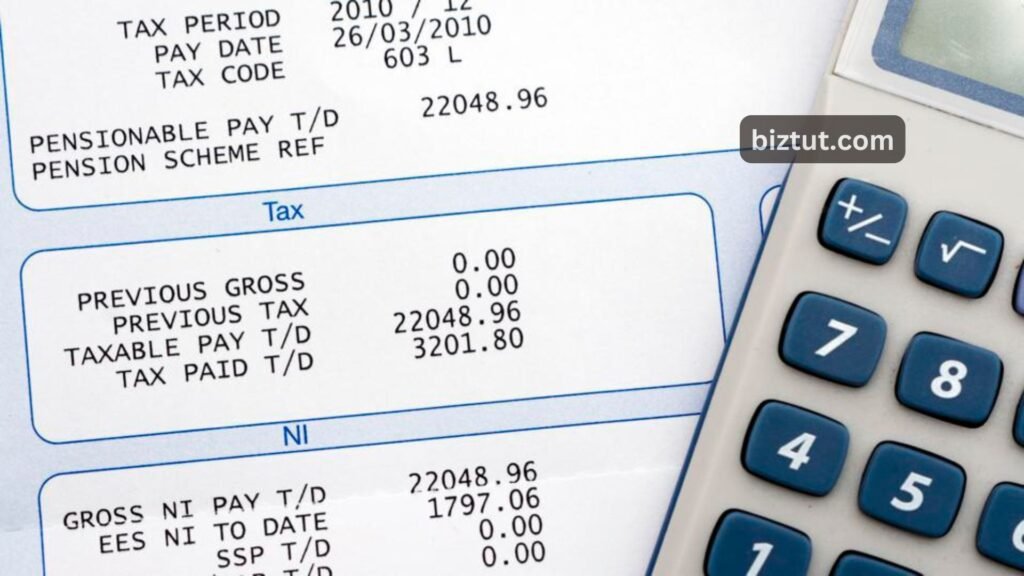

Payroll is more than just paying employees—it involves calculating wages, deducting taxes, managing benefits, and following labor laws. For small businesses, a smooth payroll process means on-time payments, accurate tax filings, and avoiding legal issues. A well-organized payroll setup can save time, keep you compliant, and help keep your team satisfied.

Payroll Basics

Understanding payroll basics is the first step in setting up a successful system. Payroll includes calculating employee earnings, deducting taxes, and ensuring accurate payments. It also involves record-keeping and following tax laws.

Key Terms

Here are some payroll terms every small business owner should know:

- Gross Pay: Total earnings before deductions.

- Net Pay: Amount after taxes and deductions.

- Withholding: Deductions for federal, state, and local taxes.

- Deductions: Benefits, insurance premiums, or retirement contributions.

Setting Up Payroll for Your Small Business

A good payroll system starts with the right setup. Whether you use software or handle payroll manually, an organized approach will keep you compliant and reduce errors.

Essential Steps

- Get an Employer Identification Number (EIN): Required for reporting taxes.

- Collect Employee Information: Includes Social Security numbers, W-4 forms, and bank details for direct deposit.

- Choose a Payroll System: Decide between manual, software-based, or outsourced payroll.

- Set a Payroll Schedule: Decide if you’ll pay weekly, biweekly, or monthly.

- Set Up Record-Keeping: Keep payroll records secure for compliance and future reference.

Calculating Employee Wages

To calculate employee wages, figure out gross pay, deduct taxes, and make sure to follow minimum wage laws. Calculations will vary based on whether employees are hourly or salaried.

Hourly vs. Salaried Employees

- Hourly Employees: Multiply hours worked by the hourly rate.

- Salaried Employees: Divide the annual salary by the number of pay periods in a year.

Accurate calculations are especially important for hourly workers who may work overtime or shifts with different pay rates.

Withholding and Deductions

When processing payroll, you’ll need to deduct federal, state, and sometimes local taxes, plus benefits and contributions.

Tax Withholding

- Federal Income Tax: Calculated based on W-4 form details.

- State and Local Taxes: Vary by location; follow state laws for withholding.

Benefits and Voluntary Deductions

These can include health insurance, retirement contributions, or donations. Make sure employees agree to voluntary deductions and that these are calculated correctly.

How to Choose a Payroll System

Selecting the right payroll system is key for efficiency. Small businesses usually have three options:

- Manual Payroll: Good for very small teams, but can be time-consuming and prone to mistakes.

- Payroll Software: Automates calculations, tax filings, and deductions; great for growing businesses.

- Outsourced Payroll: A payroll service handles everything, including compliance.

Consider your business size, budget, and compliance needs when choosing a system.

Federal and State Payroll Taxes

Payroll taxes include federal income tax, Social Security, Medicare, and state-specific taxes. Filing these taxes correctly is essential to avoid penalties.

Filing Payroll Taxes

Payroll taxes are usually filed quarterly. Get familiar with IRS forms like 941 for federal income tax and W-2 for end-of-year reporting.

Payroll Frequency Options

Payroll schedules affect cash flow and employee satisfaction. Choose the option that best fits your business:

- Weekly Payroll: Common in retail and construction; frequent paydays.

- Biweekly Payroll: Every two weeks; a popular choice for small businesses.

- Monthly Payroll: Simplifies processing, but may not work for all employees.

How to Manage Payroll Records

Accurate payroll records are essential for tax filing and compliance. Records should cover employee earnings, tax withholdings, and deductions. Digital records are ideal for security and easy access during audits.

Storing Employee Data

Store payroll data securely, ideally in a digital, encrypted format that’s backed up regularly for data security and accessibility.

Direct Deposit and Payment Options

Offering direct deposit is convenient and secure, speeding up payroll processing.

- Direct Deposit: Sends payments directly to employee bank accounts.

- Paper Checks: Less common now but still used by some businesses.

Also Read: How to Calculate Profit Margin?

Year-End Payroll Reporting Requirements

Year-end reporting is essential for tax compliance. This involves preparing and filing forms that show employee earnings and tax withholdings.

W-2 and 1099 Forms

- W-2 Forms: Report wages and taxes withheld for employees.

- 1099 Forms: For contractors who earned at least $600 during the year.

Both forms must be provided to employees and filed with the IRS by January 31.